What's Weavin' in Karur?

Nothing is more powerful than an idea whose time has come, said French litterateur Victor Hugo and Bengaluru-based Sampath Kasirajan, MD, Hydra Micro Business Solutions Pvt Ltd, could not have agreed more. A specialist in supply chain management, value chain analytics, capacity building and cluster development, he had over the last decade developed a muchresearched cluster development format but was finding no takers. From meetings to presentations it continued till at another regular B2B event he met Susindran Swaminathan, CEO, Kay Ventures, a first-generation founder chairperson of a multinational multimillion dollar textile company. Visions matched and the duo is now weaving a very successful tapestry along the banks of the river Amaravati in Karur. Known so far for its home textiles, the latter's Kay Ventures is spinning Karur into a global hub also for knitwear. Richa Bansal talks to Kasirajan and Swaminathan to learn more about this ambitious project and more.

What is happening in Karur?

SK: A very exciting story is unfolding in Karur and there is every possibility of this story rewriting the textile history of Karur, eventually the whole of textile and apparel industry in India, which is known as a global hub for quality made ups and home textiles. It is also common knowledge to many in India that Tiruppur is another major cluster that is known globally for its cotton knitwear collections. Though both these towns are only a little less than 100 km apart, the growth of Tiruppur has been phenomenal in comparison. While Karur does an export turnover of ₹4,000 crore per annum, Tiruppur has breached the ?40,000 crore mark. One of the key factors that is behind this stark difference in the turnover of these two towns is the difference in the size of the two segments they cater to. The size of the clothing sector is many times more than the home textiles market.

However, this is all set to change because knitwear made a quite entry into Karur sometime in 2016 under the name of Kay Ventures, and the credit of introducing knitwear to Karur goes to him, Susindran, the CEO of Kay Ventures Private Limited, a very dynamic entrepreneur who had both the courage and the conviction to pull this off with flair and finesse and the 6 brave entrepreneurs who decided to join this initiative unmindful of the risks involved in starting a whole new ecosystem and manufacturing resources from scratch. Many in the Karur textile fraternity had their own misgivings about the eventual outcome of this effort and rightly so because the skill and the ecosystem needed for manufacturing knitted garments simply didn't exist in Karur. Undeterred by the opinions expressed, he set about his ambition of building a brand new knitwear ecosystem here. He works relentlessly to fulfill his first goal of expanding the knitwear capacity of Kay Ventures to 10,000 machines within the next 4 years. The promise of Karur turning into a dual hub of global repute for both home textiles and knitwear products looks very real and plans are already afoot to include the woven range of garments as well in the not so distant future.

How do you start the process of building a cluster and its ecosystem?

SK: Kay Ventures and Hydra work together and the whole process starts with a field visit to understand the type of resources that are available and the textile tradition that exists. Even if there is none, the Hydra ACI format can be used for building Green Field projects ground up, provided HR is available in abundance. The type of capacities to be developed is given a fine definition and presented to large global brands and national brands. In other words, the capacity is under written before the first stone is laid. This demandled approach ensures that the type of skill imparted to the manpower, the type of machinery sourced and the type of supply chain to put in place for materials that the community of SMEs will need are in line with the type of products to be produced. This ensures that the time to market is immediate and the time to achieving break-even is lot lesser than traditional systems that start blind with a humungous inventory of wrong skills, wrong machines and wrong materials.

Kay Ventures has added an additional dimension of using a super plant to provide the scale and traction small SMEs clusters will be hard placed to produce on their own. This initial kickstart radiates from the core providing the impact while rest of the systems will need to gain the critical mass. Since HR is key to the success of clusters, Kay Ventures in parallel initiates the process of establishing highly decentralised mini manufacturing modules that are connected to the super plant. In a recent workshop that was conducted in Karur with the help of District Industry Centre, close to 200 women entrepreneurs attended the programme expressing their interest to form their own mini modules with the help of Kay Venture's Karur Chapter. This gives many women in small towns and villages an opportunity to become entrepreneurs in their own rights.

How are the SMEs responding to this shift in the market place and how are they placed now?

SK: To be fair to the SMEs, the emerging technologies are not only capital intensive but also highly skill intensive as the level of skill needed to operate high-end technologies naturally need operators with matching knowledge and skills to take advantage of the technology he/she is required to operate. The ESG - Environmental, Social and Governance - is another dimension that has only worsened the case for SMEs as the standards to be met require substantial capital and their operating costs are very cost intensive. The unfortunate part is, there is no premium by way of higher price for having a better ESG credential and the difficult part is there is no one standard and one certifying body that the buy-side believes in. This is a huge burden that the SMEs are forced to carry to be in business.

The scenario now is fast changing from "technologies as enablers of business" to "technologies as disrupters of businesses". Again, to be fair to the SMEs, these changes are happening faster than the SMEs can cope with given their meagre resources and risk profile.

There is no doubt a realisation among the SME communities that the model and economic framework that once worked very well for them and their customers isn't good enough to square up with current market dynamics and the factory standards that are now a must under the ESG standards followed by global mainstream players. The definition of Manufacturing Real Estate and Factory standards has undergone a sea change, the language of performance metrics is no more the same; likewise, the margin for error in any area is next to nothing and last but not the least, the buyers are averse to accommodating inefficiency costs and rightly so in the products they source. On the buy-side, the focus has shifted to working with strategic partners than with vendors.

What are the interventions needed?

SK: The gap in the capacity of SMEs to function in a volatile environment and with resources that will stand the ESG scrutiny of global brands has widened over the years. The governments of the day came up with a slew of interventions ranging from TUFs to cluster development schemes like SITP helping clusters to overcome the infrastructural gaps. Despite these overarching and well-intended policies of the Central and state governments, large scale transformation is yet to be witnessed and that is because there is still one major factor that stands in the way of not only creating a level playing field for the SMEs but also putting them on an equal footing with their larger counterparts in the market place. The limited gains that the SMEs were able to achieve were largely confined to the disadvantages they faced in the area of infrastructure. Under a cluster model, the SMEs were able to overcome the infrastructural gaps with real estates enabled for high quality manufacturing but still fell short of the 'scale-centric' economic advantages that were found to be crucial in helping them to compete on an equal footing with systems that were better integrated with viable economies of scale and plant size.

SS: The roles of trade bodies and associations should also become solution-centric. The tendency of representative bodies continued to rely on subsidies, grants, subventions and other financial offsets to keep their heads above the water. Against the back drop of commitment to reduce subsidies, especially in the context of WTO rulings relying on such support is not only unsustainable but also economically disastrous. In my view, it is important for an entity to stand on its own economic legs to insulate its business from political risks. Financial offsets of this kind will most certainly skew our financial structures and without any doubt can leave an organisation in the red in a flash for all it takes is a change in policy for the house of cards to come crashing. The point is the growth of an industry or sector depends on the innovation it is capable of producing at every single value link that drives it and this should not be sacrificed at the altar of easier options like a handout or financial offset. Financial offsets will have to be used selectively and only as short-term measures and only for offsetting global skews such as a GSP where duty waivers of an importing nation where it creates an undue advantage for a beneficiary nation even if its products arrive with a greater price than other competing nations.

How has it expanded? How many ventures on the anvil?

SS: The Kay Ventures Knitwear Cluster in Karur which started operations in 2016 produces annually 7.50 million pieces of knitwear predominantly for leading domestic brands and exports. Efforts are now underway to increase the capacity to 20 million pcs per annum to accommodate more orders and more customers in the near term.

Kay Ventures is close to signing an agreement with the government of Telangana with IL&FS as its knowledge partner to set up a state-of-the-art Apparel Super Hub in the textile town of Sircilla. This project is set to transform Sircilla into a world-class hub for apparel. This project was initiated by the Telangana government to create job opportunities for women employed in the declining beedi industry. In the first phase, 750 machines are to be installed which is already underwritten by a leading apparel brand. In the concluding phase, Kay Ventures will create an apparel ecosystem with 10,000 machines at Sircilla. This will be in operation creating direct jobs for 10,000 women employees.

Kay Ventures is also close to signing an MoU with the DIC - The District Industry Centre of the Government of Karnataka, facilitated by the present DC of Ballari. The project will assist manufacturers with small operations to transform into a major cluster producing denim apparel of the highest quality, both for the domestic and international markets. The project will start with 1,000 machines and scale it up progressively to touch the 10,000-machine mark within a period of 4 to 5 years.

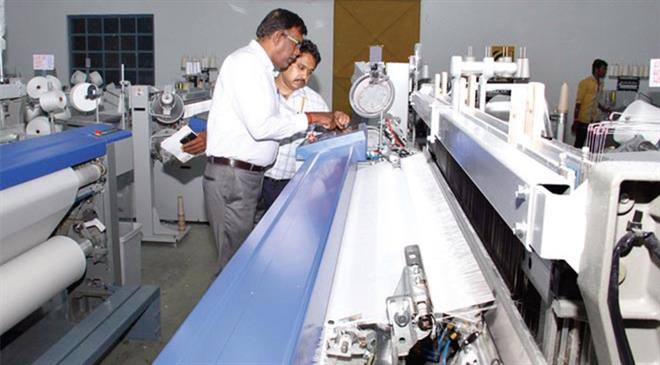

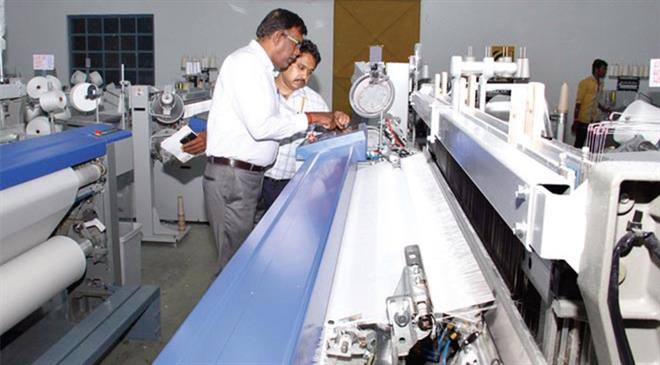

The Indiefab project is a weaving cluster which has over 142 automatic looms producing over 1.5 million metres of woven fabrics every month both in finished and greige form. The scale produced by Hydra ACI for this group has begun to produce results in the form of large enquiries and orders hitting the sales pipeline.

The versatility of the ACI framework can be witnessed in all the projects that came with their own set of baggage. The Karur ACI showcases how to successfully transplant one manufacturing culture to another ecosystem that has nothing to offer. The Ballari Cluster ACI will demonstrate how the ACI design is geared to add scale to any operation with consummate ease. The Indiefab ACI shows the advantages that fusion across the horizontal axis has to offer for SMEs. The Sircilla Project in Telangana will showcase the versatility of Hydra ACI turning a region with little or no textile culture into a world-class hub.

What convinced you to join hands with Sampath?

SS: It was a chance meeting for both of us at a traders' event in Erode where I saw Sampath's presentation and discussions on the virtues of his Hydra ACI framework in building worldclass clusters while empowering SMEs to overcome the emerging challenges and compete on an equal footing with their larger counterparts both in global and national markets. I too had been nurturing a vision to build such world-class capacities matching Industry 4.0 standards for global and national brands, and my efforts were already underway to build a knitwear ecosystem in Karur which was known only for its home textiles and madeups. I felt that Sampath's Hydra ACI offered me the perfect template to turn my vision into a scalable model leveraging the 'repeatability' of the format to deploy simultaneously at multiple locations. This evolved into a partnership where Kay Ventures became the "execution" system and Hydra became the provider of the development framework for Kay's highly nuanced ecosystem. I was clear in my intent that this private consortium should be well resourced to produce the best of values using the highest of skills and technologies possible. Choosing a top apparel brand to start with signaled this intent with immediate focus on establishing a state-of-the-art training centre with systems and methodologies geared to produce high-end skills for the factories that joined this initiative. The results of this effort could be seen in the training of 600 new operators who passed out of this training process within a matter of 30 days giving all member factories the confidence that creating a highly skilled resource in Karur is never going to be a challenge after all.

What helped Kay Ventures in building this knitwear ecosystem was adoption of the Hydra ACI Economic Framework where ACI stands for Aggregate - Consolidate - Integrate. The ACI concept is an economic platform that allows multiple firms to fuse into a single system without losing their individual identities.

What is the Hydra ACI?

SK: The Hydra ACI is an economic framework that makes it possible for multiple entities to collaborate, think and function like a single entity on a single platform.

SS: A highly researched cluster development format that was developed by Sampath over the last 10 years, the Hydra ACI framework makes it possible for SMEs across the vertical and horizontal axis to fuse into giant verticals and function like a single large enterprise without having to lose their individual identity and ownership. This fusion produces scales, efficiencies and competitive capabilities that are otherwise not possible for SMEs to achieve on their own. It was designed as a developmental framework for textile SMEs who struggle to find common cause with each other in their ecosystem that may be as small as a textile zone or a whole town like a Karur or Tiruppur.

The Hydra model enables SMEs engaged in different processes to:

- Aggregate into a vertical with multiple production lines and high-end value links

- Consolidate its resources, requirements and functions into one single 'quantum' to produce the scale and advantages of shared economics

- Integrate under a single brand umbrella engaging its consolidated capacities under a single production planning and scheduling system, using single functional systems like quality management, procurement, redress policies, code of conduct, driven by a single decision command system.

From an operational perspective this is like a fusion of several fragments into a single enterprise at various levels. This fusion enables the SMEs to assume scale that is otherwise not possible. The enterprise so formed, functions under a single command structure, leveraging the business structure that would work through a single gateway be it in delivering services or sourcing resources for the confederation. The Hydra ACI framework introduces a paradigm shift in supply chain architecture and forces the community under this architecture to function deep down at an "economic level" producing outcomes that are beyond the reach of disintegrated clusters.

SK: The ACI model draws its inspiration from the Greek mythological monster, Hydra, that has several heads but a single body. The ACI model is similarly designed, providing the framework for SMEs to fuse into one single body with multiple entities as its heads gaining capabilities that would outflank even the largest in business. The ACI is a highly intrusive framework and it requires the SMEs to step out of their comfort zones. Though the Hydra model lays down a well-structured framework to guide the SMEs in establishing their own ACI clusters, the community will have to shed its conservative outlook to understand the competitive advantages they stand to gain. The fear of being subsumed by a giant system and the threat of losing their individuality and business secrets often cited as reasons are quite misplaced.

Why do you think a model like Hydra ACI is more relevant now?

SS: I think the supply chains that serve the fashion textile and clothing segments should be the toughest and most complex among all supply chains one can think of given the fact that every item produced is a new one. Excluding the basics and standard items that run on "continuous replenishment" programmes, the fashion item's transformation from paper to product comes with a new learning curve and many man, machine and material uncertainties that turns into a complex mess when this paper-to-product process is enacted across multiple time, geographical, cultural, language and political zones. In other words, the development process spanning the paper to prototype itself had to deal with a number of time consuming iterations that left the suppliers barely enough time to produce and deliver well in time for a season. Zara was the only brand that took a leap into the future to compress the development time by designing a supply chain engine that was geared to operate at different delivery readiness levels with ability to respond to events at extreme speed and precision. This agile engine gave hope to the industry that solutions are possible indeed if there was a scientific approach to building them.

SK: Global brands were beginning to realise that their sourcing formats will have to be redesigned to serve a new shift that was in the making on the customers' side reflected in the demand cycles changing its rhythm from a brand-driven paradigm of "I decide the product options you are mostly likely to favour" to a customer-driven paradigm of "I decide what I want to buy and you will do better if you have them for me when I eventually decide". This shift takes away every single lever of control that a brand has in its possession. This shift, instead, puts the pressure on brands to run closer to a ruling trend to make its "shelf stock" decision than looking far into the future only to suffer the three debilitating uncertainty costs namely, stock out, mark down and write offs. In short, the soothsayer model in design prediction was in its last legs and the pressure on getting their sourcing acts right seemed like a battle well lost given the fact that the enabler technologies were yet to make their appearances in the late 90s, save few in the supply chain space. The closest analogy that best describes this situation is similar to witnessing a person trying to shoot a moving target at a distance and that which appears and disappears in short spells leaving him or her with a very small window of opportunity to hit the target. In the absence of any solution to deal with this new market paradigm, the buyers took several measures such as reducing the batch lot size of each style, integrating their shelf stocks to gain an universal view, reducing costs by adopting ground breaking supply chain practices such as cross-docking (Walmart), moving some of their processes to their upstream partners, helping supply side partners to reduce their production time and last but not the least, reducing their sourcing prices that were almost close to the possible salvage price of the products sourced. While these measures protected the bottom line, the top line had no answers to work with. A stock out, mark down and write off, denies a buyer the opportunity to generate revenue. Therefore, strengthening the supply chains with appropriate solutions to strengthen the revenue opportunities began to gain focus.

Where should this journey begin?

SK: Process standardisation and workflow automation is still a big missing piece in the industry and that's where this journey should begin for without this the question of enablement doesn't arise. The ability to collaborate seamlessly on a real time basis puts an enterprise at a different level and for an enterprise to acquire this ability process standardisation and workflow automation is the first matter it has to attend to. This is essential for setting the stage for other business applications such as Enquiry Management, Tech Pack compiler, OME (Order Management and Execution System), Decision Support Systems, WMS and Big Data Analytics to name a few to fall in place. This transformation is critical for enterprises to become more agile, precise and fast in responding to events as they unfold in a collaborative environment. The communications as they happen today are done over phone, email and personal meetings. This unstructured format leaves many critical data points, decisions and information outside the analytical scope of an enterprise which they could have otherwise used for being more proactive than reactive in their operations. Many would like to argue that process standardisation and workflow automation is impossible to achieve in textiles but deep within this chaos of countless loops and iterations, there is a structure that is waiting to be recognised. The fraternity should realise that this standardisation does not include the "creative spectrum" that designers use.

What's in store next?

SS: We firmly believe that technology is not only an enabler but a differentiator as well for businesses. It changes the competitive and strategic quotient of an enterprise when well designed and deployed. Most of the competitive and strategic advantages that an enterprise is likely to find now lies mostly in the technology space and SMEs are the worst affected on account of poor scales in adopting technologies that is becoming common place even in our personal lives.

SK: Keeping this point in mind, Hydra has put in place a blueprint that will see the ACI framework riding on a highly advanced tech architecture making the job of establishing context aware ACI manufacturing ecosystems that much easier.

The arrival of new technologies such as IoT, blockchain, cloud computing, AI-machine learning -deep learning, big data analytics and GPS to name a few has brought in its wake many exciting possibilities to work with. We see substantial scope for these technologies to affect a paradigm shift in the way we innovate, create, manufacture and deliver values to end consumers. It is a new Industrial Age where the opportunity to excel is limitless and Hydra ACI intends to use this opportunity to bring a new definition to cluster, especially in the developmental space that looks at strengthening the socioeconomic status of the weaker section of the societies in our country.

Does this all mean that the Cog Wheel Model that is still used by SMEs is in its last leg of its existence?

SK: The answer is a resounding No for the simple reason, demand has only fragmented and become more unpredictable with the batch lots and assortments dropping even further in terms of per design colourways. It is the quality of speed, precision, agility and the response levels of the Cog Wheel Model that is out of sync. The focus of the SMEs should therefore be on improving their performance levels against these 4 metrics to start with and that calls for a total revamp of their cog wheel engine.

How are the SMEs placed in this context?

SK: The Indian textile and apparel system is a unique one. It is made up of many small players across its value chain; from a supply chain perspective, it is spatially scattered, capacity wise fragmented and process wise highly disintegrated. The product that comes out of this value chain is made up of many decisions coming from different command structures, attitudes, ethical leanings, locations and business motives. There is no gainsaying the fact that they are often coated with a thick layer of "conflict of interest" and "expectations" that are often at loggerheads with each other. More importantly the profit plough back has always been abysmally low because the proprietary model found more safety in real estates than in a new business or manufacturing asset. The profit share and distribution itself is highly skewed impacting the "profit plough back" intentions furthermore.

Despite these disadvantages, the industry managed to sustain and survive because of the niche it was serving and the environment being so different, but this is no more the case now. The market worldwide has changed character. The arrival of social media technologies, digital tools, e-commerce and B2C online market places have dealt a severe blow to the traditional methods of fulfillment, sourcing and product development. Internet powered the possibility of virtual reality, near real time search and discovery, virtual communities and social engagement and online shopping which in turn have changed the entire social psychology and shopping behaviour of consumers.

The SME model of engagement with the demand side in its current form is not geared to serve this new environment, and to understand this one has to understand how this model of engagement works.

The Combined Manufacturing Model that the SMEs use resemble a cog wheel, for the simple reason, the final exporter like a central cog wheel in a gear box, engages and disengages with upstream partners depending on what needs to be produced. This cog wheel format, as one would agree, has as many as 6 planning and scheduling systems that come into operation to put a project together, with neither any visibility nor coordination between each other. Each function independently to their own time scale and priorities impinging the productivity and the capacity utilisation levels of each other leading to delays, cost over runs, penalties, and outright rejections. This gets worse when there isn't even a certainty as to when the flows are likely to take effect. Even though the SMEs integrate temporarily while executing an order, there are far too many conflicts of interest than the SMEs can deal with to come up with unified decisions that are singularly optimal.

In simple terms, a buffer of 30 days that an Indian exporter uses to cover for all uncertainties encountered isn't enough anymore and such buffers don't find place in high speed, quick response lanes where matters are decided on the run. There is practically no room for the line to go through even a short learning curve, as the batch lots and assortments have dropped down to a few thousands per design colourway. Technically speaking, the cog wheel model is very ideally suited to service small production runs, but from a time perspective it is no more a viable option given the fact that the time to market for a total replacement of a running trend, replacement of a variant or the top up of a running variant has dropped to almost a fraction (from 90 to almost 15 days) of what it used to be due to shortened shelf lives and market volatilities. To compound this further, as a resource guzzler, the cog wheel model has barely the cost structure it needs to stay competitive in the market place. It is full of inefficiency costs that deplete the bottom lines of both the buyer and the supplier. In short, the cog wheel engine simply doesn't have the speed and the precision to compete in a highly volatile market environment where the time to respond as events unfold has dropped next to nothing. Having said that, the Cog Wheel Model, is still a wonderful model and all it needs is a new lean collaborative engine that can function seamlessly and on a real time basis with greater speed, agility, response time and precision.

What is the ACI framework and how flexible is it, given that there are many regional nuances to deal with?

SK: It would not be an exaggeration to say that the credit of taking Hydra ACI to many locations should go to Susindran. The ACI framework as a highly flexible template can enable a cluster to take any shape or structure depending on how the constituent members wish to unite and operate. For instance, one can think of a virtual cluster where all members are already well established with their own infrastructures at different places within a town or a gated cluster where all participating manufacturing units move into one gated facility like a textile park. In addition to this physical formation, the economic formation is decided by the type of relationships the participating units would prefer to have under an ACI framework. It could be an open one with minimal binding on each other, or a confederated format that requires greater fusion under a single identity. In other words, the Hydra ACI framework offers a range of options for the communities to choose giving them time to migrate from one level to another before they turn into giant verticals with a common code of conduct, common planning and scheduling system, common facility and common marketing arm with a common identity and an operating system producing results beyond compare.