Fosun Industrial Holdings is buying a majority stake in Wolford with the main shareholder group. The purchase price is EUR 12.80 per share. The closing of the share purchase agreement is subject to fulfilment of certain conditions including clearance by the competent merger control authorities. Fosun will be the new strategic majority shareholder of Wolford.

To strengthen Wolford’s financial structure, Wolford and Fosun agreed on a cash capital increase, with shareholders’ subscription rights being maintained, which will provide EUR 22,000,000 of fresh equity to Wolford. The intended capital increase requires a resolution by the general meeting. Subject to closing of the share purchase and of a takeover offer, Fosun committed to subscribe for a cash capital increase of Wolford from EUR 36,350,000 by EUR 12,495,312.50 to EUR 48,845,312.50 by issue of 1,718,750 new shares for an issue price of EUR 12.80 per new share. This commitment includes the subscription of new shares to the extent that shareholders of Wolford do not exercise their subscription rights in full. The maximum cash contribution by Fosun hence amounts to EUR 22,000,000.Fosun Industrial Holdings is buying a majority stake in Wolford with the main shareholder group. The purchase price is EUR 12.80 per share. The closing of the share purchase agreement is subject to fulfilment of certain conditions including clearance by the competent merger control authorities. Fosun will be the new strategic majority shareholder of Wolford.#

The closing of the share purchase agreement and the general meeting are intended to take place in May 2018. The general meeting will be convened after clearance of Fosun’s share purchase by the competent merger control authorities.

In connection with the share purchase agreement Fosun also informed Wolford about its intention to launch an anticipatory mandatory takeover offer to the remaining shareholders of Wolford. The takeover will be subject to the closing of the share purchase agreement. The price per share in the takeover offer will be set in accordance with applicable takeover law. The price will amount to the weighted average stock exchange price of the last six months of EUR 13.67 per share. Therefore, the purchase price per share in the takeover offer will exceed the price per share as set forth in the share purchase agreement.

“We welcome the entry of a financially strong core shareholder which is experienced in the luxury sector and will enhance our access to Asian markets,” emphasis Axel Dreher, CEO of Wolford. “This confirms the reputation of our brand and its growth opportunities.”

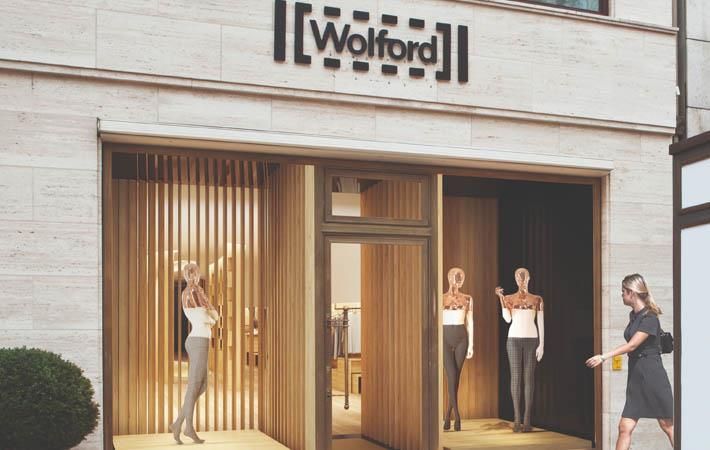

Brigitte Kurz, CFO of Wolford, points out: “The capital increase will strengthen our long-term capital base and our liquidity. This enables us to accelerate the development of our promising online business and the redesigning of our market appearance.” SV

Fibre2Fashion News Desk – India