The survey ‘2019 Consumer Retail Technology Survey’ by AT Kearney, focused on five crucial technologies: augmented reality (AR), mobile point of sale, cashier less checkout, interactive screens and 3D printing. It surfaced four crucial observations.

The first observation is that retailers are lagging consumer expectations for retail technology .While three out of four respondents were aware of at least one of the targeted retail technologies, only one in three have experienced even one of them in their shopping experiences.

For example, 45 percent of respondents said they had heard of augmented reality but never experienced it in a store. The results were similar for the other technologies: 60 per cent for 3D printing, 40 per cent for mobile point of sale, 36 per cent for cashier less checkouts, and 30 per cent for interactive screens.

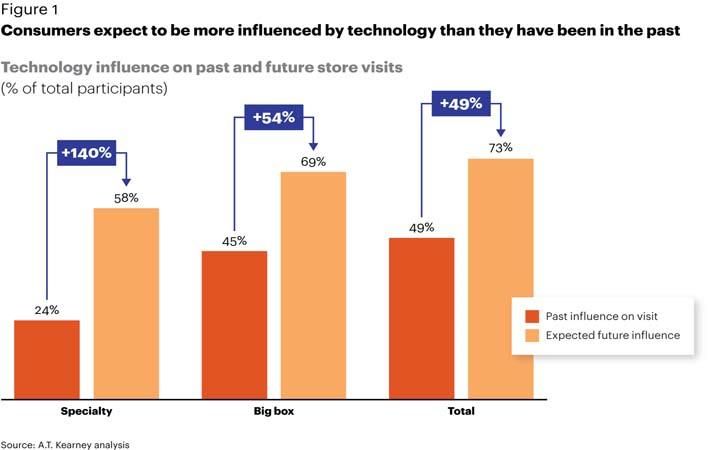

The survey revealed a nearly 50 per cent increase between the number of consumers who indicated that technology had influenced their shopping choices in the past, to those who expect technology to influence their shopping choices in the future. This represents a substantial opportunity for retailers to address consumer expectations by bridging the gap.

The second observation was – big box retailers have led in retail tech, but consumers expect specialty shops to catch up. Forty-five per cent of respondents reported visiting a big box store because of technology, contrasted with 24 per cent who said they had visited specialty stores because of technology. However, 58 per cent of consumers expect retail technology to impact their specialty store choices in the future, nearly catching up to big box and presenting specialty retailers with a significant opportunity.

The third observation was specialty consumers value experience, while big box consumers value convenience. Big box consumers clearly value convenience over novelty, with 41 per cent of respondents saying technologies associated with convenience had influenced their visit to a big box store, versus only 13 per cent because of technology associated with novelty.

Service is key for specialty consumers who are more likely to be influenced by customisation and experience than big box consumers. While convenience is still important for specialty consumers, the gap between novelty, product information, and convenience is minimal, both in terms of past influence and expected future influence.

Big box shoppers are more influenced by convenience than novelty; specialty shoppers less influenced overall.

Similarly, when asked which types of retail technology would be most likely to influence their shopping choices, respondents indicated that customisation and experience were more important in a specialty store than in a big box store, and that limited interaction and time savings were more important in a big box store than a specialty store.

Customisation and experience are more crucial to specialty shoppers. With only 35 per cent of responding specialty store shoppers expecting to be influenced by technology that limits interaction with store personnel, versus 52 per cent for big box, it is even clearer that service and experience are paramount for specialty shoppers—whether delivered through technology or store personnel.

The fourth observation was – consumers want to save time in store, but only on certain shopping activities. Retail technology that saved time ranked among the most valuable by respondents. Seventy-two per cent of consumers cited technologies that reduce checkout time, and 61 per cent of consumers cited technology that reduces time spent navigating the store.

However, consumers clearly still want to spend time in stores. Reduced time in trial and sampling ranked lowest in appeal, with only 21 per cent of consumers citing such technology as important to their shopping experience. Combined with the consumer interest in customisation and novel experience, this presents retailers with a significant opportunity to drive foot traffic through enhanced trial and sampling experiences in store.

Ultimately, retailers have to make hard choices about which technologies they invest in and the size of those investments.

The survey suggests that retailers hoping to successfully bridge the consumer ‘awareness/ experience gap’ need to do seven things: look for opportunities to implement targeted technologies quickly, favouring pilots and agile implementations over long rollouts; big box retailers should continue to invest in retail technology, but be selective to ensure it is meeting specific consumer needs at the store; specialty retailers are expected to substantially increase investment in technology that enhances the overall shopping experience, and supplement with store personnel; big box retailers should direct the majority of technology investment toward speed and efficiency; understand the nuances of the consumer journey to ensure retail technology implementations meet a specific consumer need; invest in technology to reduce time in checkout and navigation, and consider technology to enhance the in-store trial experience; prioritise top markets and doors to maximise reach of technology and ensure its investment reaches as many consumers as possible. (PC)

Fibre2Fashion News Desk – India