Developing APAC's economy to grow 4.9 per cent in 2024, forecasts ADB

Insights

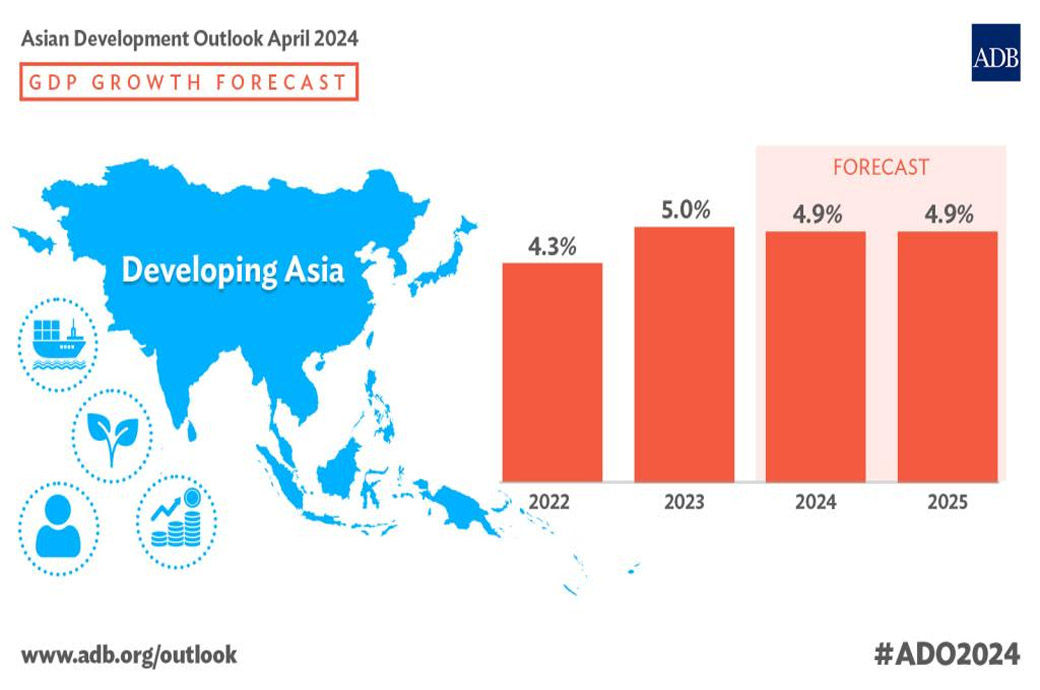

- Developing economies in Asia and the Pacific are projected to expand by 4.9 per cent on an average this year as the region continues its resilient growth amid robust domestic demand, ADB's latest Asian Development Outlook said.

- India is expected to remain a major growth engine in the region, with a 7-per cent expansion this year and 7.2 per cent next year.

Growth in these economics will continue at the same rate next year and inflation is expected to moderate in 2024 and 2025, after being pushed up by higher food prices in many economies over the past two years, the ADB report said.

Inflation in developing APAC is expected to decline to 3.2 per cent this year and 3.0 per cent next year, as global price pressures ease and as monetary policy remains tight in many economies. However, for the region excluding China, inflation is still higher than before the COVID-19 pandemic.

Stronger growth in South and Southeast Asia—fueled by both domestic demand and exports—is offsetting a slowdown in China caused by weakness in the property market and subdued consumption.

India is expected to remain a major growth engine in APAC, with a 7-per cent expansion this year and 7.2 per cent next year.

China’s growth is forecast to slow to 4.8 per cent this year and 4.5 per cent next year, from 5.2 per cent last year.

"Consumer confidence is improving, and investment is resilient overall. External demand also appears to be turning a corner, particularly with regard to semiconductors,” said ADB chief economist Albert Park in an official release.

For policymakers, the report highlighted a number of risks, which include supply chain disruptions, uncertainty about US monetary policy, the effects of extreme weather and further property market weakness in China.

Fibre2Fashion News Desk (DS)

20240507093516.png)

-Ltd..jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)