India's trade deficit has been a significant concern for the past few years. According to a Confederation of Indian Industry (CII) report, Indian exports face challenges in penetrating international markets due to issues with export financing, poor infrastructure, and underdeveloped logistics. Exogenously, China's dominance in global exports, India's dependence on imported inputs and technology, and a weak currency have exacerbated India's trade deficit.

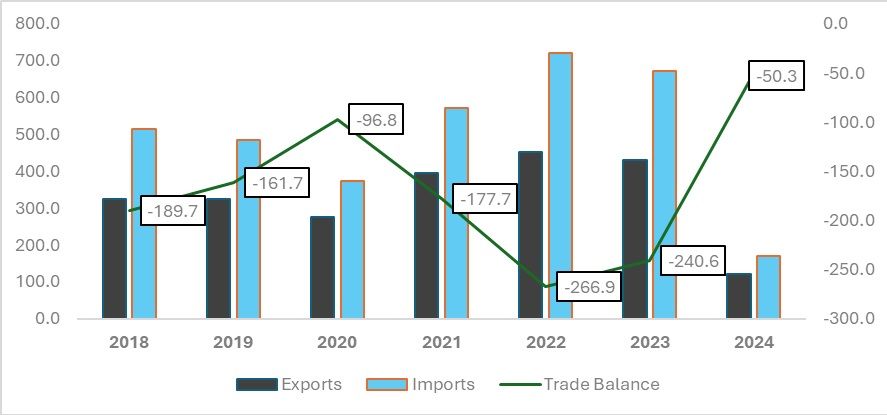

Figure 1: India’s trade balance 2018-2024 (in $ bn)

Source: Ministry of Commerce and Industry

*Please note that January-March period is considered for 2024

Despite India’s increasing exports post-COVID-19, the trade balance for merchandise goods has drastically declined, reaching $240 billion in the calendar year 2023, slightly lower than the previous calendar year's deficit of $260 billion. China has surpassed the United States as India's leading trading partner, highlighting India's growing dependence on Chinese imports from both producer and consumer perspectives. Data from the Ministry of Commerce and Industry suggests that electronic goods, drugs, pharmaceuticals, handicrafts, and cotton yarn continue to uphold India’s export competitiveness in the global market. However, it is essential to understand the causes of India's growing trade deficit to manage and control it effectively.

Reasons for India’s growing trade deficit:

· Sluggish demand for India’s merchandise, especially labour-intensive goods, from its biggest trade partners.

· Export restrictions placed by India, particularly on agricultural products, leading to lower export realisation.

· Supply chain disruptions due to geopolitical tensions, such as the Russia-Ukraine war and the Red Sea Crisis, have increased transportation costs, creating a challenging import and export environment.

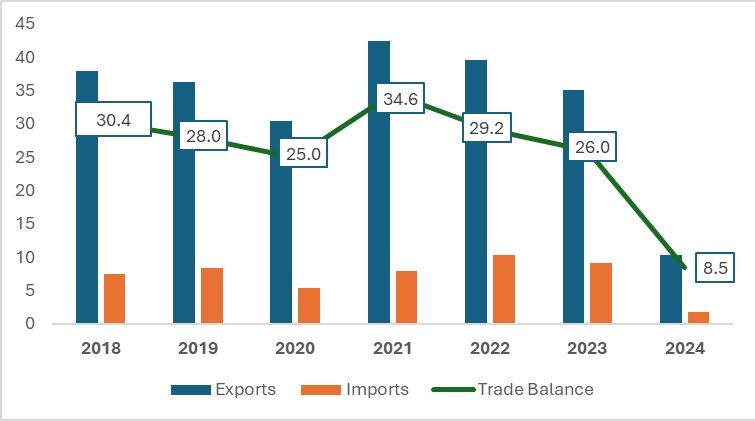

Figure 2: India’s trade balance in the textile Industry 2018-2024 (in $ bn)

Source: Ministry of Commerce and Industry

*Please note that January-March period is considered for 2024

India’s textile industry has consistently been a trade surplus contributor due to its dominance in cotton yarn and jute production, along with being the second-largest producer of silk. India has also established itself as the primary destination for hand-woven fabrics, with almost 95 per cent of these exports originating from India. Cotton yarn, fabrics, and handloom exports continue to show positive year-on-year growth. However, exports decreased by 11.09 per cent from calendar year 2022 to calendar year 2023.

India saw a trade surplus of $8.484 billion in January to March 2024. Exports show a positive year-on-year growth of 8.32 per cent for this period, while imports have decreased by 15.24 per cent year-on-year.

Despite having a trade surplus over the past five years, the textile industry has seen a reduction in surplus value after the pandemic. This does not indicate a jump in imports but rather a dip in both exports and imports, reflected in the reduced trade surplus. The trade surplus decreased by 11.96 per cent from $29.2 billion in 2022 to $26 billion in 2023. Textile exports declined from $39.5 billion in calendar year 2022 to $35.1 billion in 2023. Similarly, textile imports also saw a dip from $10.3 billion in 2022 to $9.1 billion in 2023.

Factors behind the decline in India’s textile trade

A myriad of reasons contribute to the decline in both imports and exports in the current scenario. According to a report by Crisil Ratings, the geopolitical crisis in the Red Sea, while not initially affecting the textile sector, could lead to increased freight costs if the crisis continues in 2024. Additionally, India’s textile industry has lost competitiveness due to higher production costs and lower labour costs in neighbouring Southeast Asian countries like Bangladesh and Vietnam. The global economic slowdown in developed economies such as the US and EU further hampers India's textile growth.

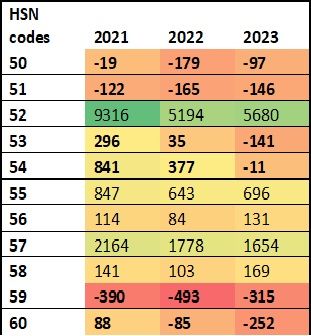

Figure 3: Textile industry and its contribution to the deficit (in $ mn)

Source-Ministry of Commerce and Industry

*HSN codes 61, 62 and 63 are not included due to consistent trade surplus

A deep dive into India's export-oriented textile sector reveals individual sectors contributing to the country's trade deficit. In the table above, green cells denote a trade surplus, yellow cells indicate a neutral balance, and red cells highlight a trade deficit. Despite an overall trade surplus in the textile industry, this is primarily due to India's dominance in cotton and related exports.

According to the latest data for calendar year 2023, HSN codes for silk (50), wool, fine or coarse animal hair; horsehair yarn and woven fabric (51), textile fabrics, impregnated, coated, covered or laminated; textile articles of a kind suitable for industrial use (59), and knitted or crocheted fabrics (60) have shown consistent declines.

Silk: Always a trade deficit item for India, the trade deficit for silk slightly reduced to $97 million in 2023 from $179 million in 2022 due to increased exports and imports. This trend continues into January to March 2024 with a trade deficit of $9 million

Wool: Consistently in deficit, wool's trade deficit increased from $122 million in 2021 to $146 million in 2023, peaking at $165 million in 2022. The deficit for 2024 (Jan-Mar) stands at $22 million.

Textile Fabrics: This category has the highest trade deficit among the 13 textile HS codes, at $315 million in 2023, down from $493 million in 2022. For 2023-2024, imports exceed exports, with a current deficit of $55 million. However, from 2022 to 2023, exports increased by 17.17 per cent and imports decreased by 12.19 per cent.

Knitted or Crocheted Fabrics: Initially showing a trade surplus in 2021, this category has seen increasing deficits from 2022 to 2023. The deficit from January to March 2024 stands at $51 million.

Additionally, a few more textile items have contributed to the trade deficit: vegetable textile fibres, paper yarn, and man-made fibres.

Strategies for Revitalising India's Textile Exports: Initiatives to Amplify Global Presence

To address the trade deficit in silk, the Central Government has announced the Silk Samagra 2 scheme with an outlay of ₹4,679.86 crore (~$561.1 million), focusing on various aspects of silk export and production. India primarily imports silk from China and Vietnam, while its major export markets include the United Arab Emirates, China, and the United States.

The Ministry of Textiles has also created a program called the Integrated Wool Development Programme (IWDP) to boost the wool sector. It will run from 2021 to 2026 with ₹126 crore (~$15.1 million) in funding approved on June 15, 2021.

The deficit in man-made fibres (MMF) is concerning given the growing demand for medical and technical textiles. India should focus on increasing MMF exports to help Indian weavers remain competitive in the price-conscious market. Technical textiles are considered a sunrise sector, with the government approving an outlay of ₹10,683 crore (~$1280.2 million) for MMF apparel and fabrics. These products are expected to play a central role in India's textile trade.

By leveraging government initiatives and increasing free trade agreements (FTAs) between India and other nations, the textile industry has the potential to effectively mitigate the nation's expanding trade deficit.

Fibre2Fashion News Desk (NS)