Interviews

5-yr outlook for US fashion sector less optimistic: study

15 Aug '19

3 min read

Pic: US Fashion Industry Association

Sourcing executives are more cautious and less optimistic now about the five-year outlook for the US fashion industry, says the sixth United States Fashion Industry Association (USFIA) Fashion Industry Benchmarking Survey. A year ago, 84 per cent respondents were optimistic or ‘somewhat optimistic’ about such an outlook. This year that figure dropped to 64 per cent.

And one-quarter of the respondents said they are ‘neutral’. That is a bad sign, according to the survey.

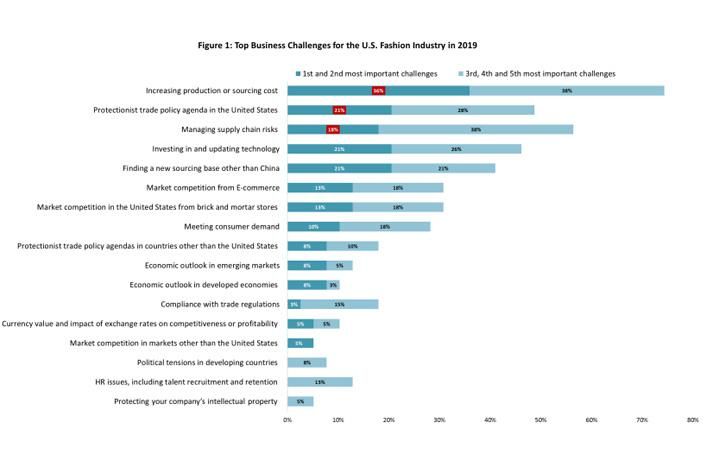

Second, the biggest challenge today for the US fashion industry is the impact of increasing production and sourcing costs, with 84 per cent of respondents saying it is a challenge this year. Some of these cost hikes are linked to the 301 action against China.

A majority of the respondents said the 301 tariffs have increased sourcing costs. Not just costs in China are increasing, but the costs to source in the main alternatives to China, especially Vietnam, Bangladesh and India, are soaring as well. And the uncertainty seems to also affect logistics and transportation costs, the survey found.

‘China plus Vietnam plus Many’ is still the most popular sourcing model among respondents.

Respondents report sourcing from as many as 48 countries or regions in 2019, led by China (100 per cent), Vietnam (86 per cent) and India (86 per cent). Asia as a whole continues to take the lead as the dominant sourcing base for US fashion firms.

China is no longer always the top supplier for US fashion companies. Around 25 per cent of respondents indicated they are sourcing more from Vietnam than from China in 2019, an important emerging trend. About 83 per cent of respondents expect to decrease sourcing from China over the next two years, up further from 67 per cent in 2018.

No evidence shows that Section 301 has benefited near-sourcing from the Western hemisphere and reshoring from the United States significantly. Instead, respondents say Section 301 has increased the production costs of textiles and apparel ‘Made in the USA’. Respondents say they are reluctant but may have to increase their retail prices, should the US-China tariff war escalate further.

As companies are moving sourcing orders to Bangladesh, Vietnam and India, the average price of US apparel imports from these countries–the main alternatives to China—have all gone up by more than 20 per cent in 2019 (January-May) year on year.

Around half of the respondents said their Chinese vendors lowered their price to keep sourcing orders in response to the trade tensions.

Benefiting from US fashion companies’ expected decrease in sourcing from China, Vietnam and Bangladesh are playing a bigger role as apparel suppliers for the US market. This year, Vietnam remains the 2nd top sourcing destination among respondents, with a 86 per cent usage rate.

Bangladesh is the 6th top sourcing destination, with 60 per cent usage. Despite the price advantages, however, respondents still see Bangladesh not as attractive as many of its competitors regarding speed to market, flexibility and agility, and risk of compliance.

Respondents also listed a few disadvantages and challenges that prevent them from sourcing more ‘Made in the USA’ products in the next five years, ranging from the high price, limitations in fabric options to a shortage of skilled labour. (DS)

And one-quarter of the respondents said they are ‘neutral’. That is a bad sign, according to the survey.

Second, the biggest challenge today for the US fashion industry is the impact of increasing production and sourcing costs, with 84 per cent of respondents saying it is a challenge this year. Some of these cost hikes are linked to the 301 action against China.

A majority of the respondents said the 301 tariffs have increased sourcing costs. Not just costs in China are increasing, but the costs to source in the main alternatives to China, especially Vietnam, Bangladesh and India, are soaring as well. And the uncertainty seems to also affect logistics and transportation costs, the survey found.

‘China plus Vietnam plus Many’ is still the most popular sourcing model among respondents.

Respondents report sourcing from as many as 48 countries or regions in 2019, led by China (100 per cent), Vietnam (86 per cent) and India (86 per cent). Asia as a whole continues to take the lead as the dominant sourcing base for US fashion firms.

China is no longer always the top supplier for US fashion companies. Around 25 per cent of respondents indicated they are sourcing more from Vietnam than from China in 2019, an important emerging trend. About 83 per cent of respondents expect to decrease sourcing from China over the next two years, up further from 67 per cent in 2018.

No evidence shows that Section 301 has benefited near-sourcing from the Western hemisphere and reshoring from the United States significantly. Instead, respondents say Section 301 has increased the production costs of textiles and apparel ‘Made in the USA’. Respondents say they are reluctant but may have to increase their retail prices, should the US-China tariff war escalate further.

As companies are moving sourcing orders to Bangladesh, Vietnam and India, the average price of US apparel imports from these countries–the main alternatives to China—have all gone up by more than 20 per cent in 2019 (January-May) year on year.

Around half of the respondents said their Chinese vendors lowered their price to keep sourcing orders in response to the trade tensions.

Benefiting from US fashion companies’ expected decrease in sourcing from China, Vietnam and Bangladesh are playing a bigger role as apparel suppliers for the US market. This year, Vietnam remains the 2nd top sourcing destination among respondents, with a 86 per cent usage rate.

Bangladesh is the 6th top sourcing destination, with 60 per cent usage. Despite the price advantages, however, respondents still see Bangladesh not as attractive as many of its competitors regarding speed to market, flexibility and agility, and risk of compliance.

Respondents also listed a few disadvantages and challenges that prevent them from sourcing more ‘Made in the USA’ products in the next five years, ranging from the high price, limitations in fabric options to a shortage of skilled labour. (DS)

Fibre2Fashion News Desk – India

Popular News

Leave your Comments

Editor’s Pick

Ritesh Dodhia

Dodhia Synthetics Limited

Pratik Gadia

The Yarn Bazaar - Filosha Infotech Private Limited

Andrea pompilio

Label - Andrea pompilio

-Ltd..jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)