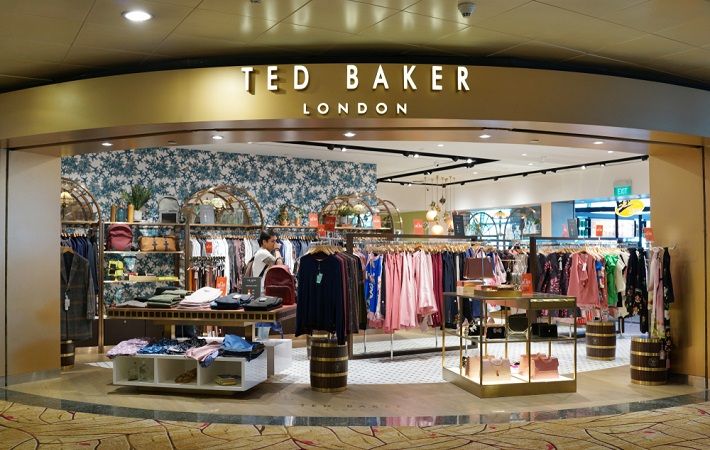

Ted Baker Plc, the global lifestyle brand, has signed an extension to its revolving credit facility with its existing lending syndicate. The new agreement extends the revolving credit facility maturity to November 2023 and amends the adjusted EBITDA covenant tests, providing further financial flexibility for the London Stock Exchange-listed group.Combined with Ted Baker's strong net cash position of £66.7 million at the end of the financial year on January 30, 2021, the amended revolving credit facility ensures the group has the necessary cash and liquidity to continue the successful delivery of its transformation plan.

Under the new agreement, the existing RCF of £108 million maturing in September 2022 and restricted RCF of £25 million maturing in January 2022, will be replaced by a new RCF of £90 million reducing to £80 million in January 2022 until maturity in November 2023.

Ted Baker Plc, the global lifestyle brand, has signed an extension to its revolving credit facility with its existing lending syndicate. The new agreement extends the revolving credit facility maturity to November 2023 and amends the adjusted EBITDA covenant tests, providing further financial flexibility for the London Stock Exchange-listed group.#

Fibre2Fashion News Desk (RKS)