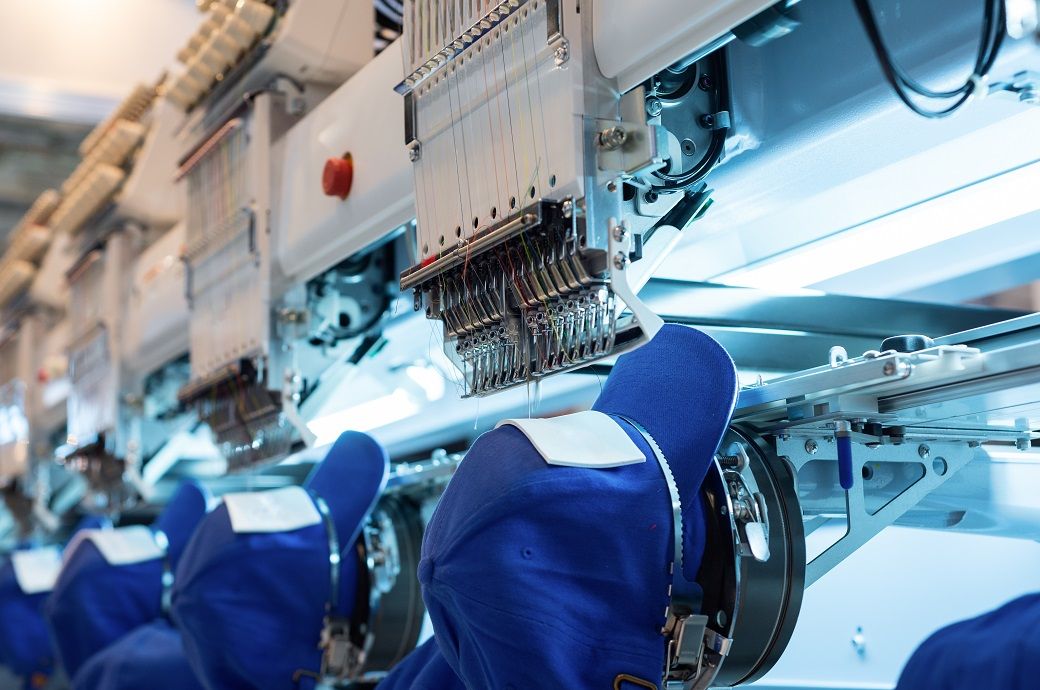

Vietnam's manufacturing health declines for 2nd month in October 2023

Insights

- Vietnam's manufacturing PMI recorded a slight drop from 49.7 in September to 49.6 in October 2023, marking the second month of contraction for the sector.

- Employment levels remained stable, ending a seven-month trend of decline.

- Rising oil prices and a depreciating dong against the US dollar contributed to increased input costs and higher output prices.

Central to the latest decline in business conditions was a further reduction in manufacturing output, the second in as many months. The latest fall was only slight as some firms increased production in line with new order growth, but on balance firms were able to cater to customer requirements without expanding their output, S&P Global said in a press release.

New orders increased for the third month running amid some signs of improvement in customer demand. That said, the rate of growth was only marginal and the weakest in the current sequence of expansion. Anecdotal evidence suggested that clients remained hesitant about committing to new orders.

Growth of new export orders also softened over the month, but remained more pronounced than that seen for total new business. Employment was broadly unchanged at the start of the final quarter of the year, thereby ending a seven-month sequence of falling staffing levels. Those panellists that increased their workforce numbers did so in response to higher new orders, while there remained a climate of optimism about the year ahead outlook for production.

The stability of employment and ongoing spare capacity in the sector enabled manufacturers to reduce their backlogs of work markedly in October. Furthermore, the rate of depletion was the strongest since June 2021.

A further build-up of inflationary pressures was signalled at the start of the fourth quarter, with both input costs and output prices rising at sharper rates. In fact, the respective rates of inflation each hit eight-month highs.

The impact of rising oil prices was widely mentioned as having pushed up input costs, with higher prices for fuel among those feeding on from rises in the cost of oil. Meanwhile, a depreciation of the dong against the US dollar added to cost pressures. In turn, firms increased their own selling prices at a solid pace.

Purchasing activity continued to rise solidly, expanding for the third month running amid efforts to build reserves of inputs ahead of expected increases in production. These efforts were often in vain, however, as signalled by a further reduction in stocks of purchases.

Stocks of finished goods were also down as manufacturers opted to use inventories to meet new orders rather than expanding production. The second consecutive monthly fall in post-production inventories was modest, but the most marked since January.

Finally, the improvements in suppliers’ delivery times that have been recorded since the start of the year continued in October amid reports of spare capacity at vendors. That said, the shortening of lead times was the least marked since April.

Fibre2Fashion News Desk (NB)

-Ltd..jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)