Financial performance & valuation of key textile companies in India

Insights

- The textile sector is a significant part of India's economy, contributing 2.3 per cent to GDP and employing millions.

- Here is an analysis of the performances of 3 leading firms in this space in the last few years and quarters.

- While Rajapalayam Mills saw a 25 per cent YoY revenue rise, Ambika Cotton and Sutlej Textiles and Industries Limited faced declines.

The textile industry in India plays a crucial role in the country's economy, contributing approximately 2.3 per cent to the national GDP. The industry is also a key player in exports, accounting for over 10 per cent of India's total exports. This places India among the top four largest textile exporters globally.

On the manufacturing front, India ranks second worldwide in the production of polyester, fibre silk, and personal protective equipment (PPE). Employment-wise, the textile industry is the second largest employer in the country right after agriculture. Surprisingly, out of the total hand-woven fabrics produced across the world, 95 per cent is produced in India.

For investors and entrepreneurs, the textile industry presents abundant opportunities for exploration and growth. Let's now delve into three textile companies that are becoming indispensable players in the industry, showing great future potential.

Ambika Cotton Mills Limited (ACML)

With over three decades of market presence, Ambika Cotton Mills is present not only across southern India, where it is based, but also across the rest of the country and abroad.

The firm, built in 1988, is based out of Coimbatore and currently has five manufacturing units located in Tamil Nadu. ACML has a 1,08,288 spindle capacity for compact knitting and spinning. The environment-friendly firm uses wind energy for all its electricity needs.

ACML produces 100 per cent cotton compact yarns where the count varies from 20s to 120s combed. This cotton is mainly used for manufacturing premium shirts and T-shirts for various brands.

Sutlej Textiles and Industries Limited

Next on our list is Sutlej Textiles and Industries Ltd, which is known for its exceptional spun yarn. It has one of the largest portfolios of yarns, which mainly includes spun-dyed, cotton melange, cotton-blended, and dyed yarns.

Their production units are spread across the country, from Rajasthan to Himachal Pradesh, and even in Jammu and Kashmir. These units mainly produce different types of yarns, while the company’s plants in Gujarat and Himachal Pradesh specialise in home textile products.

Sutlej Textiles has a strong portfolio of clients spread across the globe. It has business connections with over 62 nations including the USA, Egypt, Colombia, Italy and Africa among others.

Rajapalayam Mills Limited

Rajapalayam Mills Ltd dates back to 1938 when P.A.C Ramasamy Raja started it with 6,000 spindle machines imported from England. Today, the firm has a total of 18 units, running across Tamil Nadu, especially in Rajapalayam and Andhra Pradesh.

Rajapalayam Mills Ltd is known for its high-quality cotton, modal, micro tencel and other fibres. The company offers a wide range of yarns, from mercerised yarns to core spun yarn and a lot more.

Performance Analysis

Let us now examine how these three companies have performed over the past few years in terms of revenue, profitability and valuation.

Revenue

Let's start with the revenue to get an understanding of how the companies have performed over the last three years and the last two quarters.

The revenues of these textile businesses were hit in FY23 except for Rajapalayam Mills, whose standalone revenue went up by around 25 per cent in the previous financial year. Ambika Cotton Mills suffered a dip of around 6.93 per cent in their yearly revenues, which is the most among these three as Sutlej managed to keep the dip within check and the consolidated revenue dropped by only 0.37 per cent.

The revenues of these textile businesses were hit in FY23 except for Rajapalayam Mills, whose standalone revenue went up by around 25 per cent in the previous financial year. Ambika Cotton Mills suffered a dip of around 6.93 per cent in their yearly revenues, which is the most among these three as Sutlej managed to keep the dip within check and the consolidated revenue dropped by only 0.37 per cent.

While FY23 was not favourable for Ambika Cotton, it made sure to increase its revenue in this financial year. In the first quarter of FY24, the revenue of Ambika Cotton Mills went up by 22.47 per cent on a QoQ basis while Sutlej witnessed a drop of 5.47 per cent for the same period while Rajapalayam’s revenue also tanked by 9.37 per cent in the same quarter.

Profitability

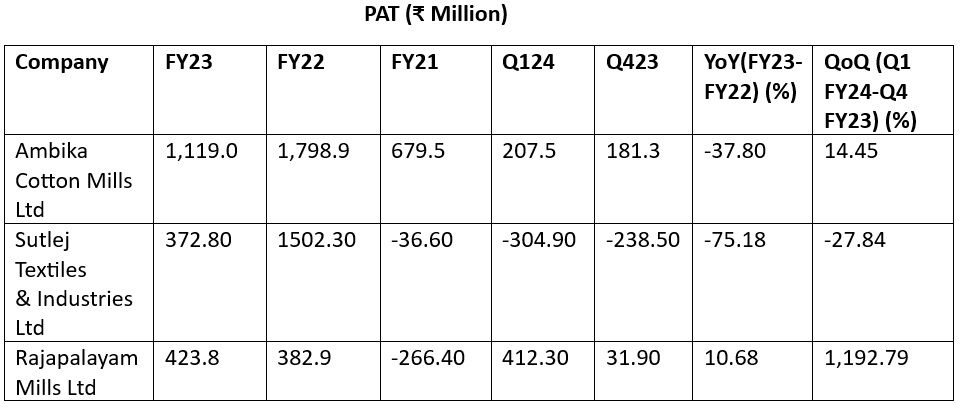

Coming to the profits made by these companies in the last three years and quarter, it is evident that Rajapalayam has been profitable on both YoY and QoQ basis. However, its quarterly profits for Q1 FY24 have increased drastically not due to its operational profits but exceptional items in the financial statements. The increase in profits on a YoY basis is due to an increase in revenues though.

On the other hand, Ambika Cotton Mills reported a 14.45 per cent surge in its Profit After Tax (PAT) on a QoQ basis for the previous quarter, while its yearly profits tanked by 37.80 per cent owing to a drop in the revenues and increasing costs of raw materials.

However, Sutlej Textiles, even being the largest by production capacity and revenues, witnessed a whopping 75 per cent drop in its profits in the previous financial year compared to the preceding financial year. On top of that, while the other two textile companies managed to report an increase in their profits in Q1 of FY24, Sutlej’s losses expanded by 27.84 per cent in the same quarter.

Valuation

Finally, the valuation of these three textile giants is assessed. For this evaluation, the price-to-earnings ratio (P/E ratio) and the price-to-book value ratio (P/B ratio) are considered.

As per both the ratios, Ambika Cotton Mills seems as the most overvalued share amongst these three while Sutlej has a negative P/E due to its dip in profits in the previous financial year and the previous quarter as well. However, its P/B ratio is at par with the industry while Rajapalayam on the other hand, has a low P/B but average P/E ratio making it a fairly valued company at present.

Final thoughts

The Indian textile industry is projected to expand to a $250 billion market in the next 7-8 years, signalling abundant opportunities for growth. The three key players in the sector continue to deliver returns to shareholders, despite experiencing a challenging last financial year. These companies maintain their market share among the elite players in the textile business.

Fibre2Fashion News Desk (WE MM)

-Ltd..jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)